Blair Atwebembeire.

In Uganda, accessing money from money lenders has become a popular option for many individuals and businesses. However, it’s crucial to be aware of certain legal aspects to ensure a smooth and secure borrowing experience. Here’s a simple guide to help you navigate the process:

1. Verify the Legitimacy of the Money Lender: Before engaging with a money lender, ensure they are a registered company. Only registered companies are allowed to operate money lending businesses in Uganda. You can verify their registration status on the Uganda Registration Services Bureau website: ursb.go.ug.

2. Check for a Valid License: Make sure the money lender holds a valid license from the Uganda Microfinance Regulatory Authority. This license signifies that they are authorized to provide lending services. Without a license, the lender might not be operating legally.

3. Physical Office Location: A legitimate money lender should have a physical office with their license displayed prominently. This helps establish their credibility and provides a place for you to visit if needed.

4. Demand a Clear Loan Agreement: Insist on a written loan agreement that outlines all the terms and conditions of the loan. This agreement should clearly state all fees and charges. Be cautious if the lender avoids providing this agreement or if any extra fees are not properly disclosed. Make sure you receive a copy.

Be cautious if the lender asks you to sign sales agreements or transfer forms for credit facilities. These practices are illegal. Loans should be based on proper loan agreements

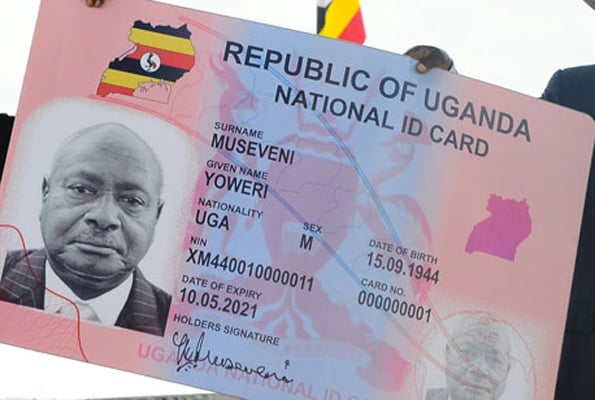

5. Beware of Collateral: Money lenders are not allowed to take sensitive documents like your National ID, passport, or ATM cards as collateral. Additionally, they cannot ask for blank cheques. Be cautious if the lender demands such items as security.

6. Understand Interest Rates: It’s important to know the interest rate being charged on the loan. Charging excessively high interest rates is against the law. Interest charged should not exceed the maximum rate set by the government. Compound interest is also prohibited.

7. Keep Records: When making payments, always ask for and retain receipts issued by the money lender. These receipts will help you keep track of your payments and the outstanding balance, preventing any disputes later on.

8. Dispute Resolution: If you face difficulties when trying to repay the loan especially when the lender is playing ‘hide and seek’, you can deposit the money with the Uganda Microfinance Regulatory Authority. This ensures that the lender cannot claim you defaulted on the loan.

9. Collateral Disposal: If the money lender intends to sell or dispose of the collateral you provided, they must first issue a written demand notice. They can only proceed with disposal if 60 days have passed since the notice was issued. You retain the right to repay any outstanding amounts and reclaim your collateral before disposal.

10. Seek Help if Needed: If you encounter any issues or suspect unfair practices or misconduct from the money lender, you can file a complaint with the Micro-Finance Regulatory Authority. They are there to assist and ensure a fair lending environment.

Taking a loan from a money lender can provide a helpful financial boost, but it’s vital to be well-informed and protected. By following these guidelines, you can make confident borrowing decisions and safeguard yourself from potential risks.

Mr. Blair Atwebembeire is an Advocate of the High Court of Uganda. E-mail: blair.advocates@gmail.com