Kerry Howard Mwesigwa.

The Ugandan government in a bold move aimed at increasing revenue and ensuring a fair tax system, is once again proposing to impose a 5 percent tax on foreign-owned companies offering digital services within the country. This development, outlined in Clause 16 of the Income Tax (Amendment) Bill, 2023, has resurfaced following President Museveni’s request for Parliament to reconsider its initial rejection of the proposal.

The government’s sights are set on major platforms like Facebook, Twitter, Google, Netflix, and Amazon, among others, which provide paid services to Ugandan users. During the Finance committee’s deliberations, Mr. Henry Musasizi, the State Minister for Finance in charge of General Duties, disclosed that the Uganda Revenue Authority (URA) aims to collect Shs 5 billion from these foreign digital companies. Minister Musasizi strongly recommended the approval of Clause 16, stressing that the 5 percent tax on their income earned in Uganda should be duly paid. He clarified that this tax is distinct from other charges imposed on resident companies and should not be confused with the Over the Top Tax (OTT), which was terminated in 2021.

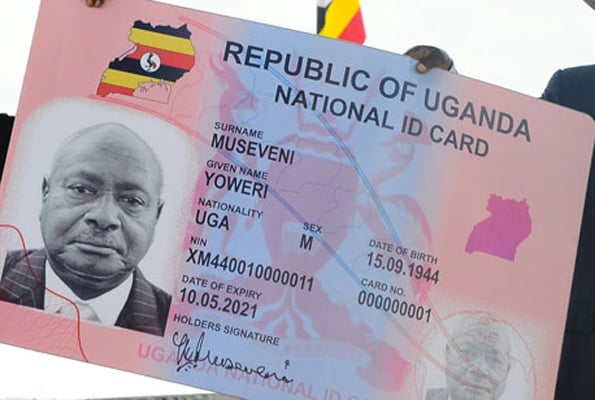

President Museveni’s letter to Parliament, read by Speaker Anita Among, called for the reinstatement of Clause 16. The proposal, previously rejected by Parliament, sought to introduce a tax on income derived from non-resident entities providing digital services in Uganda. The President’s letter clarified that the tax would not affect residents of Uganda, contrary to a mistaken interpretation in the minority report, and thus should be reinstated.

Following the President’s directive, Speaker Among instructed the Finance committee to expedite the re-processing of the legislation and present it to the entire House for passage. The proposed legislation forms part of a comprehensive tax framework designed to guide the Uganda Revenue Authority (URA) in collecting taxes during the 2023/2024 financial year, which commenced this month.

Earlier this year, the opposition led by shadow Minister for Finance, Mr. Muwanga Kivunmbi, and supported by Kampala Central MP, Mr. Muhammad Nsereko, dismissed the provision in a minority report. Their argument was that if passed, the tax would indirectly impact Ugandan consumers who use the services provided by these digital companies. Despite the opposition’s viewpoint, Parliament adopted the minority report, leading to the rejection of the government’s proposal. However, the matter has now returned to Parliament for reconsideration.

While most members of the Finance committee have pledged their support for the resolution, government officials, including those from the Ministry of Finance, have been tasked with presenting a compelling defense when the proposal is tabled for final reconsideration. Concerns were raised about the opposition’s position and how it will be addressed in this round of deliberations.

The government aims to tap into the potential tax revenue from untapped sources, as revealed by the Uganda Revenue Authority (URA) last month. Despite government efforts to expand the tax base and finance various programs, an estimated Shs 5.8 million potential taxpayers have yet to contribute to the national revenue.