By Blair Atwebembeire.

In the world of finance, where trust is paramount, the importance of protecting your investments cannot be overstated. We’ve all heard stories of borrowers falling prey to fraudulent money lenders, resulting in the loss of hard-earned money and property. However, today, I’d like to shift the spotlight onto the money lenders themselves and emphasize the significance of spousal consent in money lending transactions.

While there’s no shortage of dishonest money lenders, it’s equally crucial to acknowledge that honest business people in the money lending industry have also fallen victim to deceitful borrowers who seek to defraud them of their capital. One way that these unscrupulous borrowers have exploited the system is by creating uncertainty around their marital status, ultimately leading to the invalidation of lending transactions. Spousal consent is one key aspect that can make or break a money lending transaction.

Under Section 39 of the law, it is clear that no person should engage in the sale, exchange, transfer, pledge, mortgage, or lease of family land without the consent of their spouse. Moreover, no contract relating to family land should be entered into without the prior consent of one’s spouse. This means that even in the world of finance, marriage details are not to be taken lightly.

The law further elaborates in Section 38 that each spouse is entitled to security of occupancy on family land, which includes the right to access and reside on the land. Additionally, a spouse has the right to either grant or withhold consent in any transaction involving family land.

The absence of spousal consent renders any land pledged as security in a money lending transaction null and void, and consequently, any further action taken is unlawful. This means that in case of a borrower defaulting, the security cannot be legally disposed of to recover the loan.

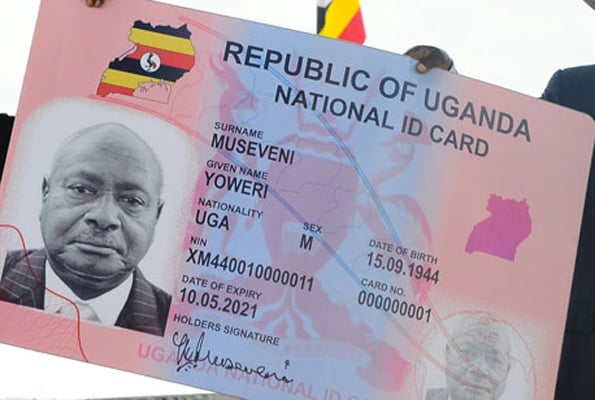

To determine whether spousal consent is required, it is crucial to establish the marital status of the borrower. While the Land Act doesn’t explicitly define a spouse, the Succession (Amendment) Act of 2022 defines a “spouse” as a husband or wife married in accordance with the laws of Uganda or another country recognized as valid in Uganda. Marriage records should ideally be registered with the Uganda Registration Services Bureau (URSB), making it easy to determine one’s marital status through a formal search.

However, challenges arise when parties claim to be customarily married without proper registration. Courts have consistently held that the failure to register a customary marriage does not invalidate it. This has provided an opening for fraudsters to manipulate the system by concealing their customary marriages and later presenting individuals as their spouses under customary law.

So, how can money lenders protect themselves against such fraudulent practices? One effective solution is to request a Marital Status Letter or certificate from URSB. These documents are typically issued to individuals intending to marry abroad to prove their single status in Uganda. However, there’s no reason why a money lender shouldn’t ask their clients to prove their single status legally before engaging in a transaction. While it may be a stretch, this precautionary step can prevent borrowers from later denying their marital status when it suits them.

Another tactic employed by fraudsters is converting commercial structures into temporary family residences to bring them under the category of family land, where spousal consent is required. To counter this, it is advisable to conduct due diligence before signing a loan agreement. Include clear clauses in the contract where the borrower confirms that the property is not family land. When necessary, involve a spouse or family member as a witness to the transaction.

The issue of spousal consent in money lending transactions should not be underestimated. It is a legal safeguard that protects both money lenders and borrowers from potential fraud and ensures that financial transactions are conducted transparently and within the bounds of the law. Money lenders must be proactive in verifying the marital status of their clients to prevent any complications down the road. In doing so, they can build trust, safeguard their investments, and contribute to a more secure and honest financial ecosystem.

Mr. Blair Atwebembeire is an Advocate of the High Court of Uganda. E-mail: blair.advocates@gmail.com