October 31, 2023

London, UK| Two law firms, DKLM and Hattens, have faced fines from the Solicitors Regulation Authority (SRA) for failing to meet Anti-Money Laundering (AML) regulations. The SRA has imposed fines of over £12,000 on each of these firms, shedding light on the critical importance of stringent AML measures in the legal profession.

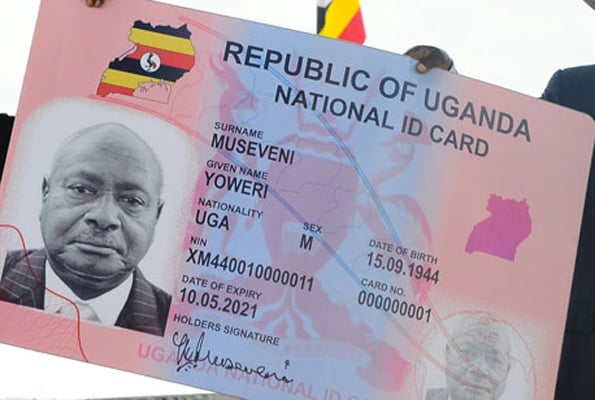

In the first case, DKLM, a London-based law firm, was penalized for inadequate due diligence in a UK property transaction involving two Ukrainian citizens. A complaint was raised regarding the miscalculation of stamp duty, affecting a first-time buyer who should not have been liable for the fee. The SRA found that the firm had overlooked the necessity of proper source of funds checks for this transaction, relying solely on documentation provided by a Ukrainian lawyer and Ukrainian law firm. This lapse raised concerns about the scrutiny of the funds’ origin and the adherence to AML guidelines. Consequently, DKLM was fined, although there was no evidence of money laundering or financial crime.

The second case involved Essex-based Hattens Solicitors, which failed to implement AML risk assessments for both the firm and individual matters. The SRA initiated a “proactive virtual AML inspection” and discovered that the firm did not have a firm-wide risk assessment in place until November 2021. The assessment that was finally established was deemed inadequate and referred to non-existent legislation, creating compliance issues. Further investigation revealed a lack of client/matter risk assessments in various case files. Hattens admitted to its shortcomings and took steps to rectify the situation.

It is important to note that there was no evidence of harm to consumers or third parties in both cases, and both firms have made efforts to ensure compliance with AML regulations.

The fines imposed on these firms serve as a reminder of the significance of stringent AML procedures in the legal profession. The SRA’s annual AML report has highlighted widespread non-compliance in the industry, emphasizing the urgency of rectifying these issues. Additionally, the SRA’s recent warning notice regarding client/matter risk assessments underlines the need for firms to consistently complete these assessments as part of their AML efforts.