By Blair Atwebembeire

OPINION, Finance | Exploring alternative investment avenues beyond traditional financial institutions has gained significant traction among individuals seeking to boost their wealth. Recently, a close friend sought my guidance on choosing between joining an investment club or opting for a Tier 4 Savings and Credit Cooperative Organization (SACCO). This discussion brought to light the common confusion surrounding these financial groups, as the terms “investment club” and “SACCO” are often used interchangeably in everyday conversations.

I clarified to my friend that investment clubs are self-help groups, where like-minded individuals pool their resources to collectively make investment decisions. Often operating under a constitution, these clubs lack legal personality. Members contribute equally to the group fund, and decisions are typically made through consensus or as outlined in the constitution. Since they lack legal status, investment clubs have limited entity capabilities, and members are usually individually liable.

On the other hand, SACCOs are registered cooperative societies with legal personalities. They exclusively provide financial services to their members and must adhere to the Cooperative Societies Act. Members’ ownership or interest in a SACCO is determined by the shares they hold, and they can operate savings accounts that may accrue interest. Unlike investment clubs, SACCOs have the ability to borrow money to finance investments and are subject to regulatory oversight. They must also fulfill specific statutory requirements, such as contributing to designated funds and maintaining minimum capital and liquidity levels.

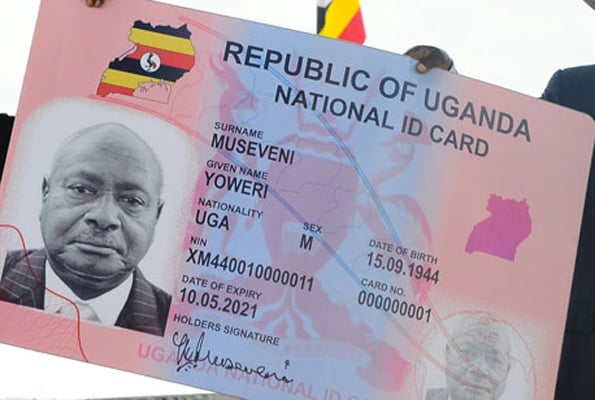

When starting an investment club, my friend and his associates would need to register the club’s constitution and provide other documentation such as passport-sized photos, proof of residence, and identity cards of members to the area Community Development Officer. Conversely, establishing a SACCO involves selecting a name, setting share-capital and membership fees, and ensuring a minimum of 30 eligible members. The proposed name and other requirements are then submitted to the Ministry of Trade and Cooperatives for registration. The SACCO must also obtain licensing from the Uganda Microfinance Regulatory Authority.

Now, the key question arises: How does one navigate the choice between the two? The answer lies in a comprehensive assessment of individual objectives, legal obligations, and desired financial services. Investment clubs offer a collaborative platform for collective savings and decision-making, ideal for those seeking a hands-on approach to investment management. Conversely, SACCOs provide a structured framework with legal backing, facilitating easy access to financial services and the potential for borrowing to fuel growth.

Ultimately, whether opting for an investment club or a SACCO, an investor must weigh the pros and cons against their specific goals and preferences. Both avenues offer unique opportunities for collective savings and investment, albeit with distinct legal structures, governance mechanisms, and regulatory obligations.

Ultimately, my friend and his associates must carefully evaluate these considerations to determine which option best aligns with their objectives and preferences. Whether they choose the informality of an investment club or the more structured framework of a SACCO, the key is to embark on their investment journey with clarity and foresight. After all, informed decisions and prudent choices pave the path to financial prosperity.

Blair Atwebembeire is an Advocate of the High Court of Uganda. E-mail: blair.advocates@gmail.com