By Blair Atwebembeire.

A sole proprietorship is the simplest form of business structure in Uganda. It is a business owned and operated by a single individual, who is referred to as the sole proprietor. In this business structure, there is no legal distinction between the business and the owner. The owner has complete control and responsibility over the business’s operations, profits, and liabilities.

Some of the key features of a sole proprietorship in Uganda include:

- Ownership: The sole proprietor owns the business and is solely responsible for its management and operations. They have the right to make all decisions and retain all profits generated by the business.

- Liability: The sole proprietor has unlimited personal liability for the debts and obligations of the business. This means that if the business incurs debts or faces legal issues, the owner’s personal assets can be used to settle those obligations.

- Taxes: The income generated by the sole proprietorship is considered the personal income of the owner and is subject to personal income tax rates. The owner is responsible for filing their income tax returns and paying any applicable taxes.

- Decision-making: As the sole owner, the proprietor has the authority to make all business decisions without consulting any partners or shareholders. They have full control over the operations, policies, and direction of the business.

- Capital and Financing: The sole proprietor provides the initial capital for the business and is responsible for its financial needs. They may invest their personal funds or obtain loans or credit to finance the business.

- Continuity and Succession: A sole proprietorship is closely tied to the owner. If the owner passes away or decides to retire, the business may cease to exist unless it is transferred to another individual or converted into a different business structure.

It is important to note that while a sole proprietorship is the easiest and most common business structure for small businesses in Uganda, it may have certain limitations, such as limited access to financing options and potential challenges in scaling the business.

While it is not mandatory to register a sole proprietorship in Uganda, it is advisable to register with the Uganda Registration Services Bureau (URSB) to obtain legal recognition and protect the business name. To start and register a sole proprietorship business in Uganda, you may follow these steps:

- Choose a Business Name: Select a unique name for your business. Make sure it is not already registered by conducting a search on the Uganda Registration Services Bureau (URSB) website or visiting their office.

- Business Permits and Licenses: Determine if your business requires any specific permits or licenses based on its nature and industry. Contact the relevant authorities, such as the Ministry of Trade, Industry, and Cooperatives, to find out the specific requirements.

- Tax Identification Number (TIN): Obtain a Tax Identification Number (TIN) for your business. You can apply for a TIN at any Uganda Revenue Authority (URA) office or through their online portal.

- Business Location: Choose a physical location for your business. Depending on the nature of your business, you may need to comply with specific zoning or licensing regulations.

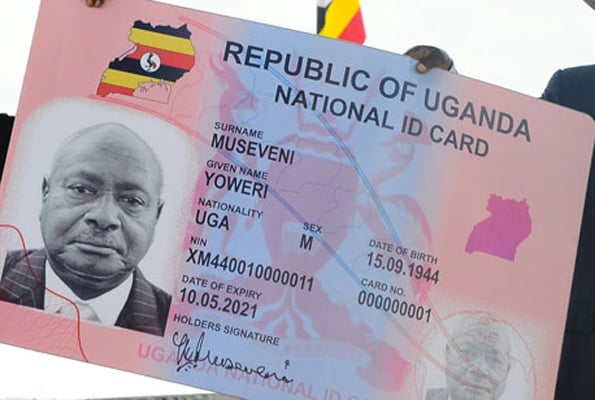

- Register with URSB: Visit the Uganda Registration Services Bureau (URSB) office or their online portal to register your sole proprietorship. Prepare the following documents:

- Completed Application Form

- Copy of your valid identification (e.g., passport or national ID)

- Two passport-size photographs

- Business name reservation certificate

- TIN certificate

Pay the required registration fee and submit the documents to the URSB.

- Business Registration Certificate: Upon successful registration, you will receive a Certificate of Registration from the URSB. This certificate serves as legal proof of your sole proprietorship.

- Register for Value Added Tax (VAT): If your business turnover exceeds the threshold set by the Uganda Revenue Authority, you will need to register for VAT. Consult with the URA or a tax advisor to determine if your business needs to be VAT registered.

- Open a Business Bank Account: Visit a bank of your choice and open a business bank account in the name of your sole proprietorship. This will help you keep your personal and business finances separate.

- Compliance with Regulatory Requirements: Ensure that you comply with all legal and regulatory requirements applicable to your business, such as obtaining necessary permits, filing tax returns, and maintaining proper accounting records.

It is recommended that you consult with a business lawyer or seek professional advice to ensure compliance with all legal obligations and understand any specific requirements related to your industry.

Mr. Blair Atwebembeire is an Advocate of the High Court of Uganda. E-mail: blair.advocates@gmail.com