Aziz Kalisa/Kerry Mwesigwa.

Making a will is a crucial step to ensure that your property is distributed according to your wishes after your death. This article aims to provide a layman’s guide to making a will in Uganda, covering the legal requirements, key considerations, and provisions to include. By understanding the process and following the proper procedures, you can create a legally binding will that protects your loved ones and ensures the smooth transfer of your assets.

Understanding the Importance of a Will in Uganda:

A will is a legal document that outlines how your assets and property should be distributed after your death. In Uganda, having a will is essential for several reasons:

- It allows you to determine who will inherit your property, whether it’s family members, friends, or charitable organizations.

- It provides a clear plan for asset distribution, minimizing potential conflicts among family members.

- It ensures that your wishes are respected and followed.

Legal Requirements for Making a Will in Uganda:

To make a valid will in Uganda, you must meet the following requirements:

- You must be of sound mind and not a minor.

- A married woman can dispose of property that she could alienate during her life.

- Deaf, dumb, or blind individuals can make a will if they understand its consequences.

- If you have periods of unsound mind, you can make a will during a period of sound mind.

- You must have the mental capacity to understand the implications of making a will.

- You must not be under the influence of alcohol, illness, or any condition that impairs your understanding of the will.

Key Legislations Governing Wills in Uganda:

In Uganda, the legal requirements for making a will are governed by various legislations, including:

- The Constitution of Uganda 1995: This sets out fundamental principles and rights related to property ownership and inheritance.

- The Succession Act Cap 162: This is the principal legislation governing wills in Uganda. It outlines the rules and procedures for making a will, testamentary capacity requirements, rights of spouses and children, and estate administration and distribution.

- The Administrator General’s Act: This legislation provides for the appointment of an administrator to handle the estate of a deceased person who died without a valid will or whose will is deemed invalid.

- Islamic Law and Customary Law: These laws may apply to individuals who adhere to Islamic or customary practices and have specific rules regarding wills and inheritance.

Writing Your Will: Lawyer or Self-Drafted?

In Uganda, you have the option to write your own will without the assistance of a lawyer. However, it is recommended to seek legal advice to ensure compliance with all legal requirements and effectively carry out your intentions. Consulting a lawyer can help you avoid potential errors or disputes that may arise from an improperly drafted will.

Ensuring the Legally Binding Nature of Your Will:

To ensure that your will is legally binding in Uganda, follow these steps:

- Clearly state that the document is your last will and testament.

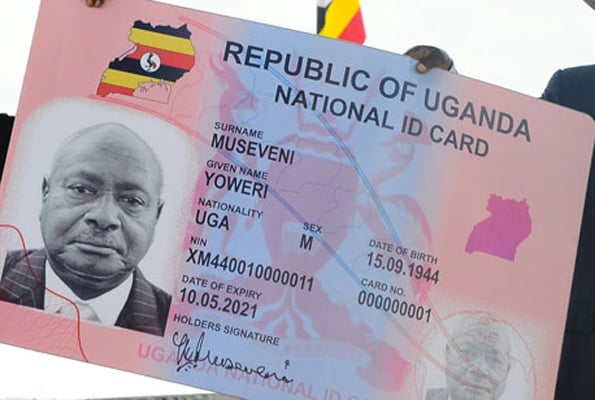

- Identify yourself as the testator, providing your full name, address, and date of birth.

- Include a statement revoking any previous wills or codicils.

- Clearly outline how you want your property to be distributed and to whom.

- Appoint an executor responsible for administering your estate.

- Sign and date the will in the presence of at least two witnesses.

- Ensure that the witnesses also sign the will in your presence.

Changing or Revoking Your Will:

In Uganda, you have the right to change or revoke your will. Several methods allow you to do this:

- Create a new will that explicitly revokes the previous one.

- Draft a codicil, which amends specific provisions of your will.

- Physically destroy the will with the intention of revoking it.

- Marry, divorce, or enter into a civil partnership, as these events automatically revoke certain parts of your will.

It’s important to note that any changes or revocations to your will should be properly documented and executed in accordance with the legal requirements to ensure their validity.

Storage and Accessibility of Your Will:

After creating your will, it’s essential to store it in a safe and accessible place. Inform your executor, trusted family member, or lawyer about the location of your will. Consider the following options for storing your will:

- Home safe or locked cabinet: Ensure that it is fireproof and protected from theft or damage.

- Bank safety deposit box: Contact your bank to inquire about their procedures and fees for storing important documents.

- Lawyer’s office: If you sought legal assistance, your lawyer may offer to store your will securely.

Informing Relevant Parties:

To ensure a smooth administration of your estate after your passing, it’s crucial to inform relevant parties about the existence and location of your will. These may include:

- Your executor: Discuss your wishes, provide them with a copy of the will, and inform them of its location.

- Close family members: Inform your spouse, children, or other beneficiaries about the existence and location of your will.

- Lawyer or legal advisor: If you worked with a lawyer to draft your will, inform them about its completion and provide them with a copy for safekeeping.

Regularly Reviewing Your Will:

Life circumstances and personal relationships can change over time, which may necessitate updates to your will. It is advisable to review your will periodically or in the following situations:

- Marriage, divorce, or entering a civil partnership.

- Birth or adoption of children or grandchildren.

- Changes in your financial situation or assets.

- Changes in your beneficiaries’ circumstances.

- Death of a beneficiary or executor named in your will.

When reviewing your will, consider whether any amendments are necessary to reflect your current wishes accurately. Consult with a lawyer if you have any doubts or require legal advice on updating your will.

Conclusion: Making a will in Uganda is a crucial step in ensuring that your wishes are honored and your assets are distributed according to your instructions after your passing. By understanding the legal requirements, seeking legal advice if necessary, and following the proper procedures, you can create a legally binding will that protects your loved ones and provides clarity for the administration of your estate. Remember to review your will periodically and make necessary updates to reflect any changes in your life circumstances or intentions.